Employees can contribute up to $2,750 per year. Your employer determines which health care expenses are eligible under your hra.

Hra Eligible Expenses Webinar Infographic Ebooks

This means you’ll save an amount equal to the taxes you would have paid on the money you set aside.

What is fsa/hra eligible health care expenses. You can view a comprehensive list of eligible expenses by logging into your wageworks account. Check your plan details for more information. 16 rows various eligible expenses.

A certification of medical necessity form must be completed by your physician. What are eligible health care fsa expenses? A health reimbursement account (hra) is a fund of money in an account that your employer owns and contributes to.

Expenses that are for personal care, cosmetic, or general health purposes are not eligible. Due to frequent updates to the regulations governing these accounts and arrangements, this. [fsa] or a flexible spending account.

How do you get it? Eligible expenses in an hra will vary depending on plan design. Also, these arrangements can pay or reimburse preventive care expenses because they can be paid without having to satisfy the deductible.

An hra is funded solely by the employer and the reimbursements for medical expenses, up to a maximum dollar amount for a coverage period, aren't included in your income. Enrollment is through the employer if they offer an fsa. Common hsa, hra & fsa eligible expenses.

You determine how much money you want to contribute to each account for the plan year. It’s an account to help employees pay for eligible medical expenses. An eligible hra expense is any healthcare expense incurred by an employee, their spouse, or dependent, that is approved by the irs and eligible for reimbursement under your specific company plan.

View a comprehensive list of eligible expenses for each type at. You can use your health care fsa (hc fsa) funds to pay. You can use your account to pay for a variety of healthcare products and services for you, your spouse, and your dependents.

The following list is based on eligible and ineligible expenses used by federal employees. In addition, the irs announced on march 26, 2021 that personal protection equipment (ppe) purchased on or after 1/1. An employer may limit what expenses are eligible under an hra plan.

Although the rules for deductibility overlap in many respects with the rules governing health fsa, hra, and hsa reimbursement, there are some important differences. Refer to your plan documents for more details. Refer to your enrollment materials for the details of your plan.

It’s an account to help employees pay for eligible medical expenses. Eligible medical expenses incurred by employees and their dependents enrolled in the hra. If you are enrolled in a limited medical fsa or combination medical fsa, your eligible expenses may be different.

You don’t pay taxes on this money. A flexible spending account (fsa) is a spending account for different kinds of eligible expenses. Expenses that primarily prevent, treat, diagnose or alleviate a physical or mental defect or illness are eligible.

It’s a personal bank account to help employees save and pay for qualified medical expenses. [hra] a health reimbursement account. An eligible expense is defined as those expenses paid for care as described in section 213 (d) of the internal revenue code.

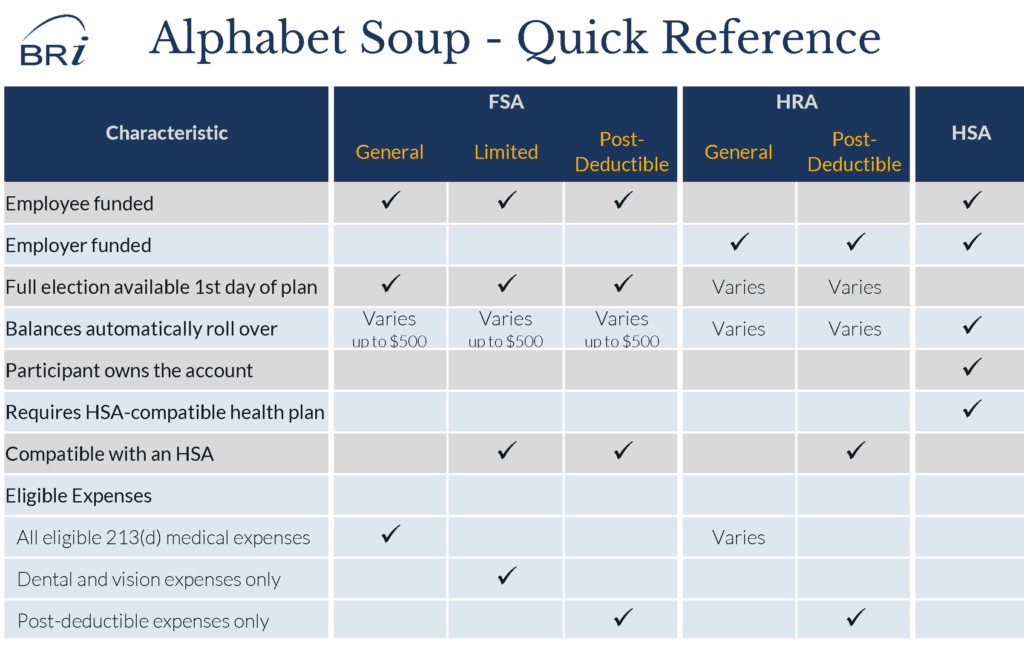

Let’s take a look at where they’re alike — and where they’re not — starting with. There are three kinds of fsas that may be available if you choose your own. Potentially qualifying health care expenses.

Unlike a flexible spending account (fsa) or health savings account (hsa), the employer owns the hra and completely funds it. Below are two lists which may help determine whether an. Hras are only available to employees who receive health care coverage from an employer.

The account allows for employees to pay for eligible healthcare expenses.

Hsas Vs Msas Vs Fsas Vs Hras What They All Mean Health Savings Account Savings Account Finance Saving

Using Your Health And Benefit Visa Debit Card

What You Need To Know About Hsas Hras And Fsas Anthem

How An Hra Works Nuesynergy

Fsa-eligible Items Top Tips And What You Can Purchaseat A Glance

Hra Eligible Expenses One Sheet - Optum Financial

Health Care And Dependent Care Fsas Infographic - Optum Financial

Understanding Hra Eligible Expenses - Bri Benefit Resource

Hra Plan Types A Breakdown Infographic - Datapath Inc

Eligible Expenses For Hsas Fsas And Hras Rocky Mountain Health Plans Blog

The Perfect Recipe Hra Fsa And Hsa Benefit Options

Hsa Fsa And Hra Eligible Expenses Cigna Health Savings Account Health Health Care

Hsa Hra Healthcare Fsa And Dependent Care Eligibility List Independent Health Agents

Health Reimbursement Arrangement - Hra

2

Health Care Consumerism Hsas And Hras

2

Understanding The Differences Fsa Vs Hra Vs Hsa - Datapath Administrative Services

Fsa Hra Hsa Eligible And Ineligible Expenses Cigna Hsa Health Savings Account Expensive

Comments

Post a Comment